A. The Distribution of Government Revenue and Financial Arrangements of India

“If we turn from the sources of wealth to its distribution, and to the financial arrangements of India, the same melancholy picture is presented to us. The total revenues of India during the last ten years of the Queen’s reign – 1891-92 to 1900-1 – came to 647 million sterling. The annual average is thus under 65 millions, including receipts from railways, irrigation works, and all other sources. The expenditure in England during these ten years was 159 millions, giving an annual average of nearly 16 million sterling. One-fourth, therefore, of all the revenues derived in India, is annually remitted to England as Home Charges. And if we add to this the portion of their salaries which European officers employed in India annually remit to England, the total annual drain out of the Indian Revenues to England considerably exceeds 20 millions. The richest country on earth stoops to levy this annual contribution from the poorest. Those who earn £42 per head ask for 10s. per head from a nation earning £2 per head. And this 10s. per head which the British people draw from India impoverishes Indians, and therefore impoverishes British trade with India. The contribution does not benefit British commerce and trade, while it drains the life-blood of India in a continuous, ceaseless flow.

For when taxes are raised and spent in a country, the money circulates among the people, fructifies trades, industries, and agriculture, and in one shape or another reaches the mass of the people. But when the taxes raised in a country are remitted out of it, the money is lost to the country for ever; it does not stimulate her trades or industries, or reach the people in any form. Over 20 million sterling are annually drained from the revenues of India; and it would be a miracle if such a process, continued through long decades, did not impoverish even the richest nation upon earth.

The total Land Revenue of India was 17.5 millions in 1900-01. The total of Home Charges in the same year came to 17 millions. It will be seen, therefore, that an amount equivalent to all that is raised from the soil, in all the Provinces of India, is annually remitted out of the country as Home Charges. An additional sum of several million is sent in the form of private remittances by European officers, drawing their salaries from Indian Revenues; and this remittance increases as the employment of European officers increases in India.

The 17 millions remitted as Home Charges are spent in England (1) as interest payable on the Indian Debt; (2) interest on railways; and (3) as Civil and Military Charges. A small portion, about a million, covers the cost of military and other stores supplied to India.

A very popular error prevails in this country that the whole Indian Debt represents British capital sunk in the development of India. It is shown in the body of this volume that this is not the genesis of the Public Debt of India. When the East India Company ceased to be rulers of India in 1858, they had piled up an Indian Debt of 70 millions. They had in the meantime drawn a tribute from India, financially an unjust tribute, exceeding 150 millions, not calculating interest. They had also charged India with the cost of Afghan wars, Chinese wars, and other wars outside India. Equitably, therefore, India owed nothing at the close of the Company’s rule; her Public Debt was a myth; there was a considerable balance of over 100 millions in her favor out of the money that had been drawn from her.

Within the first eighteen years of the Administration of the Crown the Public Debt of India was doubled. It amounted to about 140 millions in 1877, when the Queen became the Empress of India. This was largely owing to the cost of the Mutiny wars, over 40 million sterling, which was thrown on the revenues of India. And India was made to pay a large contribution to the cost of the Abyssinian War of 1867.

Between 1877 and 1900, the Public Debt rose from 139 millions to 224 millions. This was largely due to the construction of railways by Guaranteed Companies or by the State, beyond the pressing needs of India and beyond her resources. It was also largely due to the Afghan Wars of 1878 and 1897. The history of the Indian Debt is a distressing record of financial unwisdom and injustice; and every impartial reader can reckon for himself how much of this Indian Debt is morally due from India.

The last items of the Home Charges are the Civil and Military Charges. This needs a revision. If Great Britain and India are both gainers by the building up of the British Indian Empire, it is not fair or equitable that India alone should pay all the cost of the maintenance of that superb edifice. It is not fair that all the expenses incurred in England, down to the maintenance of the India Office and the wages of the charwoman employed to clean the rooms at Whitehall, should be charged to India. Over forty years ago one of the greatest of Indian administrators suggested an equitable compromise. In a work on Our Financial Relations with India, published in 1859, Sir George Wingate suggested that India should pay all the expenses of Civil and Military Administration incurred in India, while Great Britain should meet the expenses incurred in England, as she did for her Colonies. Is it too late to make some such equitable adjustment today? India’s total Civil and military Charges, incurred in England, come to 6 million – a sum which would be considerably reduced if it came from the British taxpayer. Is it too much to expect that Great Britain might share this burden, while India paid all the Civil and Military charges incurred in India?

These are the plain facts of the economic situation in India. Given these conditions, any fertile, industrious, peaceful country in the world would be what India is today. If manufactures were crippled, agriculture overtaxed, and a third of the revenue remitted out of the country, any nation on earth would suffer from permanent poverty and recurring famines. Economic laws are the same in Asia as in Europe. If India is poor today, it is through the operation of economic causes. If India were prosperous under these circumstances, it would be an economic miracle. Science knows no miracles. Economic laws are constant and unvarying in their operation.”1

B. India at the Commencement of the 20th Century – Some Important Statistical Data and Information

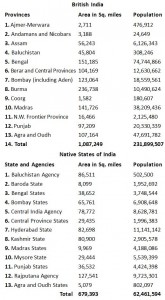

“The area and population of India, according to the Census of 1901, are shown in the following tables.

Revenues and Expenditure:- The gross revenues of British India in 1901-02 amounted to £76,344,526. Deducting Railway and Irrigation Receipts, the net revenues of British India were £53,580,985, or in round numbers 53.5 million sterling. The population of British India being under 232 millions, the taxation per head of population is very nearly 4s. 8d. per head.

The income of the people of India, per head, was estimated by Lord Cromer and Sir David Barbour in 1882 to be 27 rupees. Their present income is estimated by Lord Curzon at 30 rupees. Exception has been taken to both these estimates as being too high; but we shall accept them for our present calculation. Thirty rupees are equivalent to 40 shillings; and the economic condition of the country can be judged from the fact that the average income of the people of all classes, including the richest, is 40 shillings a year against £42 a year in the United Kingdom. A tax of 4s.8d. on 40 shillings is a tax of 2s.4d. on the pound. This is a crushing burden on a nation which earns very little more than its food.

In the United Kingdom, with its heavy taxation of £144,000,000 (excluding the cost of the late war), the incidence of the tax per head of a population of 42 million is less than £3. 10s. The proportion of this tax on the earnings of each individual inhabitant (£42) is only 1s.8d. in the pound. The Indian taxpayer, who earns little more than his food, is taxed 40 percent more than the taxpayer of Great Britain and Ireland.

The total expenditure for 1901-02 charged against Revenue was £71,394,282. Deducting Railway and Irrigation expenses, the nett expenditure was £49,650,229. Out of this total the Civil Departments and charges, in India and in England, cost £15,286, 181; and the Army services cost £1 5,763,931.

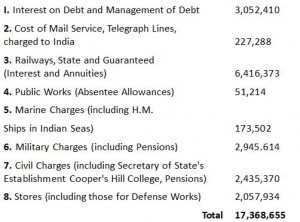

Home Charges:- Returning once more to the Gross Expenditure of £71,394,282, we find that, out of this total, a sum of £17,368,655 was spent in England as Home Charges – not including the pay of European officers in India, saved and remitted to England. The Home Charges may be conveniently divided into the following heads:–

The largest items are Interest on Debt, Railways, and Civil and Military Charges. How the Indian debt was first created by the East India Company by an unjust demand of Tribute, and how it was increased by charging to India the cost of the Afghan and Chinese Wars, the Mutiny Wars, and the Abyssinian and Soudan Wars, has been shown in previous chapters. To what extent this debt is justly and morally due from India, and how far it is entitled to an Imperial Guarantee which would reduce the Interest, are questions which we do not wish to discuss here.

For half a century the Indian railways did not pay, but were nevertheless continuously extended. The working expenses, the interest on capital spent, and the profits guaranteed to private companies, exceeded the earnings by over 50 million sterling – a clear loss to the Indian taxpayer. In recent years the lines have paid; but how long this state of things will continue we do not know. And it is an additional loss to India that the interest on capital and the annuities are withdrawn from the earnings of the lines in India, and paid in England to the extent of 64 million a year. The money does not flow back to India, is not spent among the people of India, and cannot in any way fructify the trades and industries of India.

Lastly, the Civil and Military charges include payments to the Imperial Exchequer, salaries of the Secretary of State’s establishment, and also pensions of retired civil and military officers. The people of India can justly call upon their British fellow-subjects to bear a portion of the cost of an empire beneficial alike to England and to India. It is a mean policy to make India alone pay for a concern from which India alone is not the gainer, and a readjustment of the Civil and Military Charges, on the lines indicated by Sir George Wingate more than forty years ago, is urgently needed.

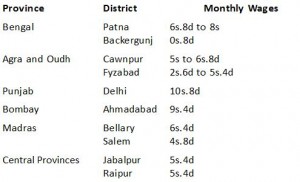

Wages and Prices:– The average monthly wages of able bodied agricultural laborers in different parts of India during the last half of 1902 are shown below from official figures.

Leaving out exceptionally rich districts like Backergunj, Delhi, and Ahmadabad, and exceptionally poor districts like Fyzabad, the wages of the able-bodied agricultural laborer range from 4s. 8d. to 6s. 8d. a month. Except in very rich districts, therefore, the agricultural labourer does not get even 3d. a day; his average earnings scarcely come to 2.5d. per day. Some deduction should be made from this, as he does not get employment all through the year; and 2d. a day therefore is more than he hopes to get throughout the year. The appalling poverty and joylessness of his life under such conditions cannot be easily pictured. His hut is seldom rethatched, and affords little shelter from cold and rain, his wife is clothed in rags; his little children go without clothing. Of furniture he has none; an old blanket is quite a luxury in the cold weather; and if his children can tend cattle, or his wife can do some work to eke out his income, he considers himself happy. It is literally a fact, and not a figure of speech, that agricultural laborers and their families in India generally suffer from insufficient food from year’s end to year’s end. They are brought up from childhood on less nourishment than is required even in the tropics, and grow up to be a nation weak in physique, stunted in growth, easy victims to disease, plague or famine.

Agriculturists who have lands are better off. They are better housed, better clothed, and have more sufficient food. But a severe Land Tax or rent takes away much from their earnings, and falls on the laboring classes also. For where the cultivator is lightly taxed, and has more to spare, he employs more labor, and labor is better paid. In Backergunj, where the land is lightly rented and the cultivator is prosperous, the laborer employed by him gets 10s. 8d. a month. In Salem, where the land is heavily taxed, and the cultivator is poor, the laborer he employs earns 4s. 8d. a month. It is this fact which appeals strongly to the Indian economist familiar with the circumstances of his fellow-villagers; it is this fact which is ignored by the Settlement Officer when he enhances the Land Tax. A moderate Land Tax relieves the landless village laborer as much as the cultivator; a heavy Land Tax presses ultimately on the landless labourer, deprives him of work, reduces his wages, and renders him an easy victim to the first onset of famines. We have in these pages again and again urged a limitation of the Land Tax within moderate and definite limits, because a moderate and definite Land Tax is calculated to improve the condition of the entire village population of British India – all the 200 millions who own lands and who labour on lands. And the Native States of India would soon follow the lead of the British Government in this matter, as they do in other details of administration.

The official compilation from which we have taken the above figures does not furnish us with the wages of unskilled labour in towns. Speaking from our own knowledge, we should say that in large towns like Calcutta and Bombay, an able-bodied unskilled labourer earns 4d. a day, or 10s. a month. A skilled labourer, like a common mason, carpenter, or blacksmith, earns 20s. to 30s. a month in towns.

The price of rice exported from Calcutta in January 1903 was about 4s. 8d. the maund, a maund being 82 Ibs. The price of Delhi wheat of good quality was 40s. the candy. But in most Provinces of India, the labourers live on inferior food – Bajra and Jowar, and other coarse grains.

Foreign Trade:– The total imports of merchandise and treasure into India during 1901-02 (excluding Government stores and treasure) was £67,412,798; and the total exports from India during that year was £88,618,297, showing a balance against India of over 21 million sterling. The United Kingdom sent goods to the value of 43 million, or two-thirds of India’s total imports. Austria sent 2.5 millions, Germany 2 millions Belgium 2 millions, Russia 2 millions, and Australia 2.5 millions. France imported into India goods worth over £900,000 and the United States nearly £800,000. Of India’s total imports; no less than 22 millions were of cotton yarn and manufactures, largely from Lancashire. The next largest items are, sugar, nearly 4 millions; iron and steel over 3 millions; machinery and mill work 2 millions; and mineral oils 2.5 millions.

Of the exports from India, the United Kingdom took 23 millions, or one-fourth of India’s total exports. Germany took 6.75 millions, France 6 millions, Belgium 3 millions, Austria 1.5 millions, Italy 2 millions, the United States 5.5 millions, Egypt 3.5 millions, China 11.75 millions, the Straits Settlements 7 millions, and Japan 4.5 millions. The largest exports were, rice and wheat, 11.5 millions, raw cotton 9.5 millions; cotton yarn and manufactures 8 millions; hides 5.5 millions; jute and jute manufactures 13.5 millions; seeds 11 millions; opium 5.5 millions; and tea 5.5 millions sterling.

Economic Condition of the People:– There was a pressing and influential demand in England for an inquiry into the economic condition of the people of India after the recent famines; but the Secretary of State resisted the demand and refused the inquiry. The latest inquiry of the nature was made fifteen years ago by Lord Dufferin’s Government in 1888, but the results were never published, and were regarded as confidential. This concealment of facts does not appear to us to be a wise action; the alarming poverty and resourcelessness of the people of India are not a secret, and an evil is not remedied by being hidden from the eye. Large portions of the confidential reports of 1888 have, however, already been placed before the public: and there can be no harm, therefore, in referring to them briefly in the present chapter.

In the Province of Bombay it is denied that the greater portion of the population lives on insufficient food. But there are ‘depressed classes’ all over the Province, and some of them live below the poor standard of the Indian workman’s life and earnings. In the Ratnagiri District, with its miserable soil and heavy payments for land, ‘there was hardly a season in which this population did not endure without a murmur the hardships of a Deccan famine.’ Land is less fertile in the Deccan than in Gujarat, and ‘authorities are unanimous that many cultivators fail to get a year’s supply from their land.’ In the Karnatic also, ‘the reporting authorities agree that there is a large number of cultivators who do not get a full year’s supply from their lands.’ Even in the favored division of Gujarat, the cultivator gets only a six or nine months’ supply from his field, and most of it goes to the money-lender as soon as the harvest is reaped. And ‘some of the numerous deaths assigned to fever are caused by bad or insufficient clothing, food, and housing.’

In the Punjab the condition of the agriculturists and laborers is no better. In Delhi Division ‘the diet is of a distinctly inferior class, even judged by the comparatively low standard of the country.’ In Gurgaon District the standard of living is perilously low, herbs and berries are consumed for want of better food, and short food is the cause of migration. The extra Assistant Commissioner of Ferozepur reports that men in many villages do not get food for two meals in twenty-four hours. The Assistant Commissioner of Lahore reports that a considerable number of the people are underfed. Two Mahomedan officers of Rawalpindi Division tell us a still sadder story. One of them maintains that 10 percent of the Hindu and 20 percent of the Mahomedan population are weak and unhealthy from insufficient food; the other says that a great portion of the lower class of agriculturists belong to this category. ‘The people of Hill Tracts in Hazara,’ says Colonel Waterfield, C.S.I. ‘whether agricultural or grazing, may, I think, generally be called a poor, ill-grown, and underfed-looking race.’

In the Central Provinces, we are told that, in Sagor, Ilamoh, Narsinghpur, Hoshangabad, Nimar, and Nagpur Districts, ‘three-quarters of the tenants are reported to be in debt, and from the details which are given, it is evident that the position of a large proportion of them is one of hopeless insolvency.’

Province of Agra and Oudh:– The reports of this Province are more ample and more explicit. The Collector of Etawa writes: ‘The landless laborer’s condition must still be regarded as by no means all that could be desired. The united earnings of a man, his wife, and two children, cannot be put at more than 3 rupees (4s.) a month. When prices of food grains are low or moderate, work regular, and the health of the household good, this income will enable the family to have one fairly good meal a day, to keep a thatched roof over their heads, and to buy cheap clothing, and occasionally a thin blanket.’

The Collector of Banda writes: ‘A very large number of the lower classes of the population clearly demonstrate by the poorness of their physique that they are habitually half-starved, or have been in early years exposed to the severities and trials of a famine. And it will be remembered that if any young creature be starved while growing, no amount of subsequent fattening will make up for the injury to growth.’

The Collector of Ghazipur writes: ‘As a rule, a very large proportion of the agriculturists in a village are in debt.’

The Commissioner of Fyzabad quotes Mr. Bennett’s statement that, ‘It is not till he has gone into these subjects in detail that a man can fully appreciate how terribly thin the line is which divides large masses of people from absolute nakedness and starvation.’ And the Commissioner adds: ‘I believe this remark is true of every district of Oudh, the difference between them consisting in the greater or smaller extent of the always large proportion which is permanently in this depressed and dangerous condition.’

The same Commissioner wrote in the Pioneer that, ‘It has been calculated that about 60 percent of the entire native population are sunk in such abject poverty that, unless the small earnings of child-labor are added to the small general stock by which the family is kept alive, some members of the family would starve.’ As regards the impression that the greater portion of the people of India suffered from a daily insufficiency of food, he writes: ‘The impression is perfectly true as regards a varying, but always considerable part of the year, in the greater part of India.’

‘Hunger,’ writes the Deputy Commissioner of Rai Bareili, ‘as already remarked, is very much a matter of habit; and people who have felt the pinch of famine as nearly all the poorer households must have felt it – get into the way of eating less than wealthier families.’”2

C. Some Statistical Information Revealing the Extent of the British Exploitation of India and the Growth of Britain at the Expense of India

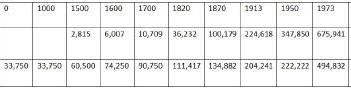

The British Empire will be judged by history as the most oppressive, repressive and cruel institutions in the modern times. The Empire took out all the prosperity out of the country. The manufactures lost their industries, the cultivators were grounded down by a heavy and variable taxation, the revenues of the country were to large extent diverted to England and that the man made famines swept away millions of population. The figure in the following table clearly shows the extent of British exploitation of India and the growth of Britain at the expense of India.

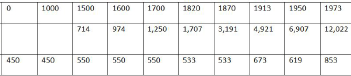

India’s and United Kingdom’s GDP from 0-1998 A.D. (million 1990 international $)

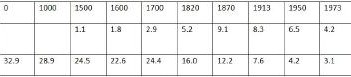

Share of India’s and United Kingdom GDP, 0-1998 A.D.(per cent of world total)

United Kingdom and India’s per Capita, 0-1998 A.D. (1990 international $)

Source: Angus Maddison, The World Economy: Historical Statistics, pp. 261-65 and 115, Organisation for Economic Co-operation and Development, 2003

References:

- Romesh Chandra Dutt, The Economic History of India – II, Director, Publications Division, New Delhi, 2006, pp.vi-viii

- Ibid., pp.420-26